The Power of Compound Interest

The Power of Compound Interest

- By Rachel Snowden

As Albert Einstein said: “Compound interest is the eighth wonder of the world. The one who understands this - earns, the one who does not understand - pays it".

What is compound interest? “Difficult” does not mean that it is difficult to understand. Compound interest is the calculation of profit from an ever-growing capital, which takes into account both the originally invested amount and the interest on it accrued for previous periods.

Let's take a look at how to use the compound interest formula and how it works.

In order to calculate the future value of your investment, taking into account compound interest, you need to know the following:

-

- interest rate (%);

- the amount of investment (initial invested capital);

- period or frequency of charges (for example, year, quarter, etc.);

- the period during which the money works (time interval);

- capitalization, additional investments or interest withdrawal.

The formula for calculating the future value of an investment is as follows:

FV = P * (1 + r)n

where:

FV – future investment value

P – principal amount

r – interest rate

n – number of billing periods.

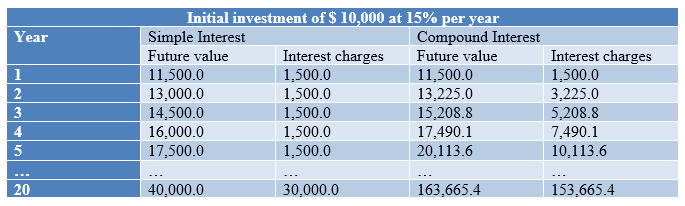

Let's see how compound interest works with an example. Let's imagine you have $ 10,000 and the opportunity to invest it at 15% per year. After one year, your capital will be $ 11,500. Now let's imagine that you are not withdrawing interest, then after two years your capital will be $ 13,225 and after three years - $ 15,208.8, etc. A significant effect is obtained over a long period of time. Table 1 shows the calculation of the future value of investments for a period of 20 years, taking into account simple interest and compound interest.

Table 1 – The calculation of the future value of investments for a period of 20 years, taking into account simple interest and compound interest

So, after 20 years at simple interest, your capital will be $ 40,000 versus $ 163,665.4 at compound interest.

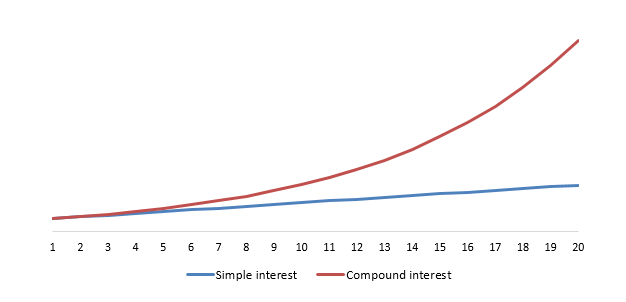

Graph 1 clearly shows how simple and compound interest work.

Graph 1 - Graph demonstrating the difference in returns of an investment with simple interest and an investment with compound interest

So, if you do not withdraw interest for a long period of time, then you can significantly increase your capital, and if you regularly replenish the initial investment amount, the numbers will increase exponentially.

The key feature of compound interest is its ability to work in various types of investments: from a simple bank deposit to stocks, bonds, etc.

If you have decided to invest your money for a long time, then before choosing where to invest money at compound interest, calculate the profitability and risks for different options.